Apply for a Kviku loan in Sorsogon City

The loan application form at Kviku is uncomplicated and direct. Initially, complete the online form found on their website. Here, you'll be asked to supply details such as your name, date of birth, social security number, phone number, and email address. This part is relevant only for first-time applicants; if you've provided your details previously, the system already has them, allowing you to continue with the online loan application. Kviku promises that after the application is complete, money instantly will be transferred to your bank account.

FAQs

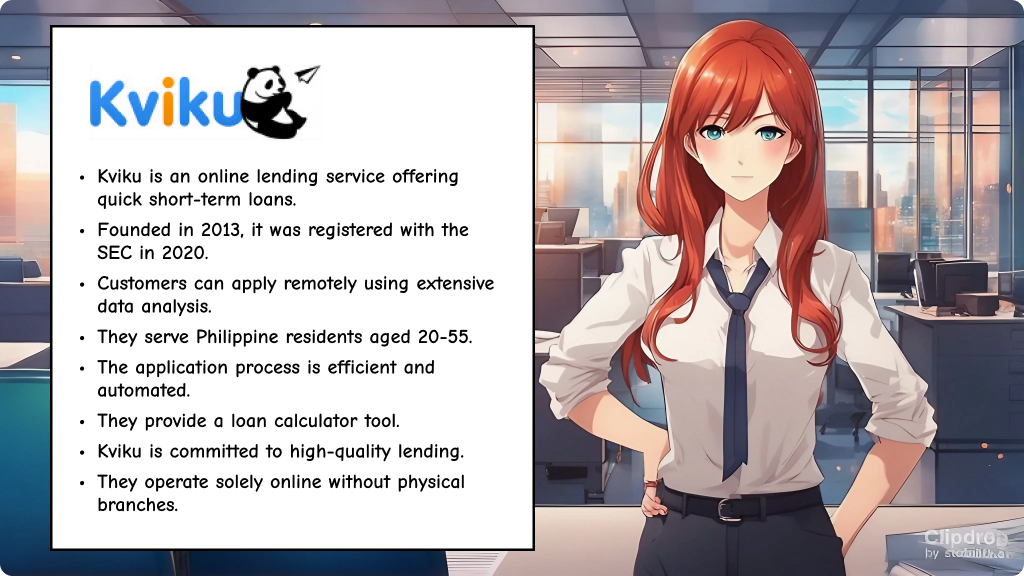

Kviku is a widely recognized Fintech firm, active in regions including Russia, Kazakhstan, Spain, Poland, and the Philippines, specializing in immediate online lending services. It maintains an online loan application platform enabling Filipinos to submit loan applications around the clock.

For any lending company to operate in the Philippines, it must be duly authorized. The securities and exchange commission (SEC) oversees this authorization process. On the official SEC website, you can locate the:

Upon verification, we found Kviku Lending Co. INC in the list of lending companies. Here are its details:

Company Name: Kviku Lending Co. INC. Registration No.: CS201918702 Certificate of Authority: 3169

This data confirms that Kviku is a legitimate lending company, as per the securities and exchange commission listings. It signifies that Kviku operates within the boundaries of the Philippine law, has undergone the necessary scrutiny by the regulatory bodies, and is trustworthy.

If you're wondering about the kviku Philippines review or its authenticity, rest assured. Kviku Philippines is SEC registered and has the necessary certification. Embrace a new era of advanced financial needs met by trustworthy companies like Kviku.

Interest rate: 56% APR (4,6% per month; 0,16% per day)

The trust of 100 million users testifies to the efficiency and value of Juanhand loans. Besides JuanHand loans, Kviku's online credit also offers a daily interest rate of 0.16%. For a clearer understanding of repayments, Kviku's website features a loan calculator. Simply input the loan amount and repayment duration, and the tool provides a detailed loan breakdown, including repayment dates.

It's important to mention that the interest rate might differ depending on the approved amount (which might be lesser than the amount initially applied for) and the chosen repayment duration.

Loans from Kviku range between ₱500 to ₱25,000, with a repayment duration spanning 3 to 6 months. For newcomers, Kviku sets an initial credit boundary. With timely repayments, this limit gradually increases, allowing users to qualify for larger loans.