About the online lending platform

Kviku is a digital lending platform providing swift, uncomplicated, and handy access to short-term internet loans. Through its completely mechanized Kviku internet loan service, loan applicants can request a loan without the burden of extensive paperwork or the necessity to visit various banks.

Kviku is an automated loan assessment and disbursement service created by Kviku Lending Co. INC. With its base in Makati City, Philippines, Kviku was initiated in 2013 and was officially registered by SEC in 2020. Customers can request a Kviku loan with zero personal interactions. It's an innovative advanced software capable of examining and scrutinizing over 1800 data points about a prospect/client based on the details provided in their form. The company has seen over 5 million applications and granted over 1 million loans amounting to $70 million since its inception.

Advantages of a Kviku Loan

- Efficiency Defined: All procedures have been simplified for a hassle-free loan experience.

- Completely Online: No branch visits required. Application can be made anytime, even beyond traditional banking hours or during weekends.

- Rapid Approval: Loans get approved in as little as 24 hours, with funds directly deposited into bank accounts.

- Transparent Costs: No hidden fees or extra charges. Every expense is clear from the start of the application process.

Strengths and weaknesses

In case of financial difficulties, a loan from Kviku could be beneficial. However, it is crucial to be well-informed about all the advantages and disadvantages.

Strengths

The application procedure is straightforward and speedy.

The system is fully automated. Everything, from application to disbursement, is performed online with no manual interference.

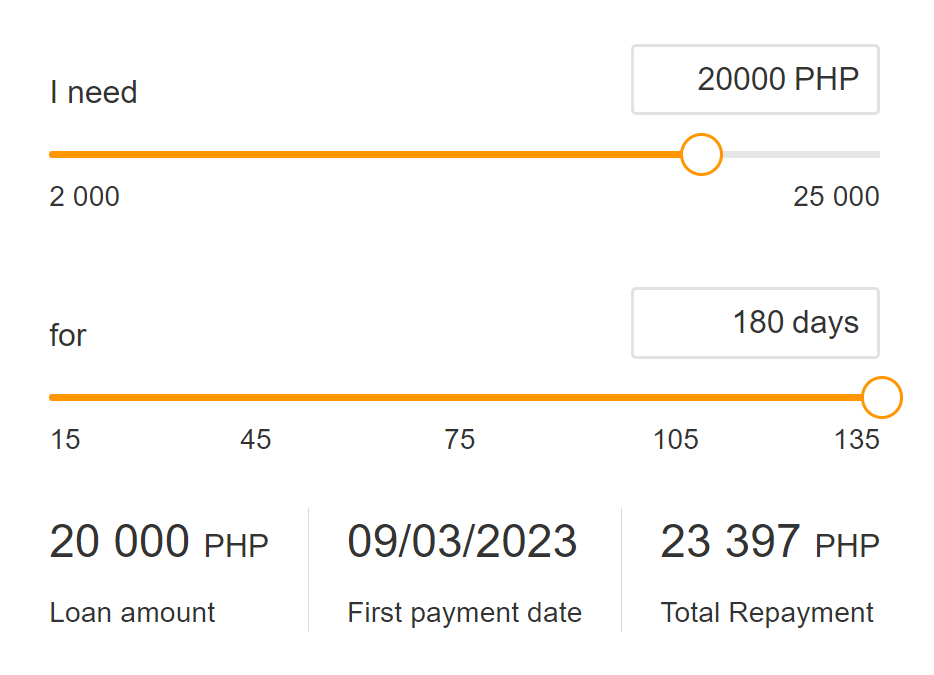

A loan calculator is also provided. By inputting your loan sum and repayment duration into the calculator, a detailed loan outline is generated. This helps avoid unexpected surprises.

Personal information is securely protected.

Weaknesses

Compared to traditional bank loans, Kviku interest rate is steeper, and the difference could be substantial for larger online loans.

Disbursement delays. It may take some time to access the funds. Depending on your bank's policies, the waiting period could stretch up to two days.

Kviku loan terms

The Kviku loan is designed for Filipino residents aged 20 to 55. You may be eligible for a loan of ₱500 to ₱25,000 with a daily competitive interest rates from 0.16% and a repayment period of 60 days for their installment loans. You are also required to have a valid government ID, an active mobile number, and a bank account. After ensuring that you fulfill the prerequisites, you can register on the Kviku website. While some of these prerequisites are optional, fulfilling them enhances your loan approval odds. Since your initial loan is approved, the documentation process is not needed for future online loans. Your details are already recorded in the system as a repeat borrower, allowing you to initiate the application right away. For first-time borrowers, you may be eligible for a maximum period of 60 days. For repeat borrowers, the maximum can be extended to 180 days.

Reloan terms

Each customer is assigned an individual loan limit by the Kviku service. If you are clear of any overdue payments on previous online loans, you have the privilege to obtain another loan within these boundaries. Upon repayment of the previous online loan, Kviku also enhances the available loan limit for the borrowers at equivalent interest rates. After the repayment of the preceding online loan, the next loan services will be immediately accessible.

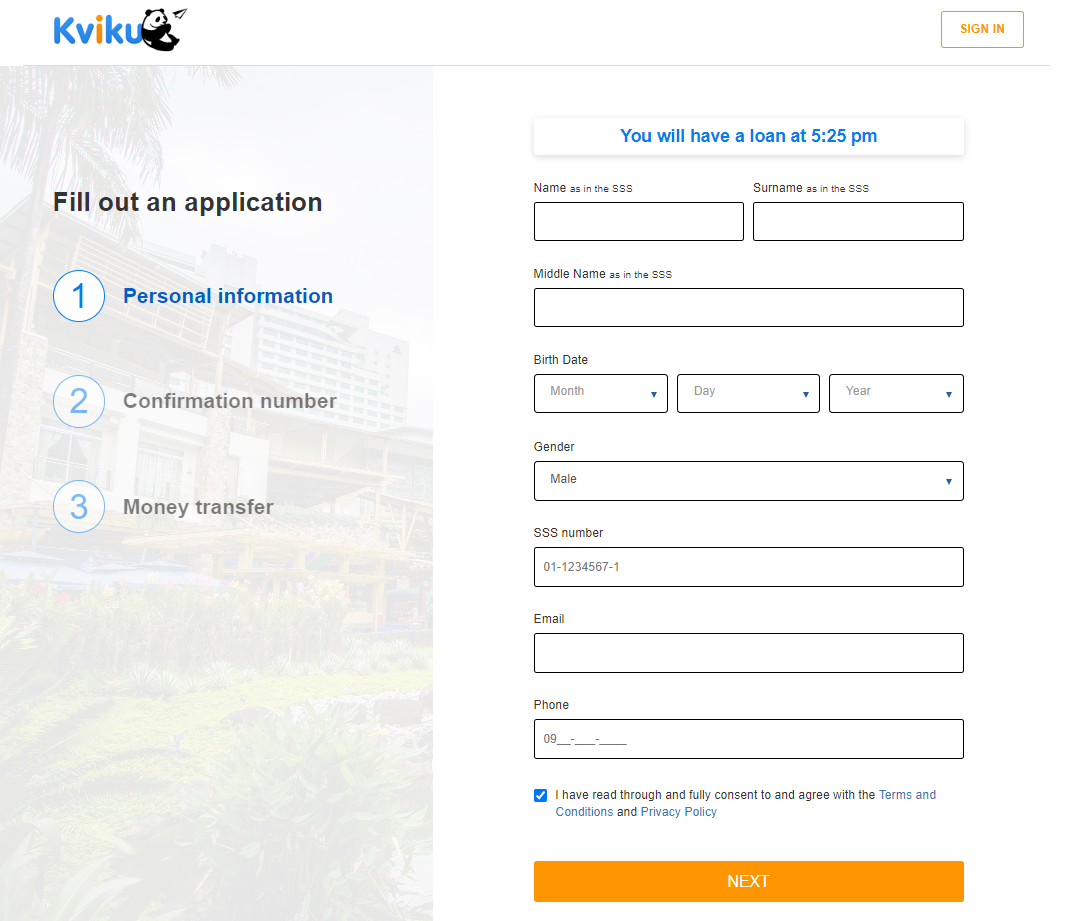

Kviku loan funding

To initiate your application for a Kviku loan, you are required to complete the application form online from their website. Here, you need to provide details such as your name, date of birth, social security number, phone number, and email address. This section pertains solely to new applicants; if you have previously submitted your details, the system already possesses them. In that case, you can continue with the loan application. Your application is reviewed as promptly as possible after its submission. Typically, this process is completed within one business day. Once your application is approved, you will receive an SMS containing a code. This code is employed to confirm the transaction, and the funds are transferred to your account within an hour.

Apply for a loan

The loan application form at Kviku is uncomplicated and direct. Initially, complete the online form found on their website. Here, you'll be asked to supply details such as your name, date of birth, social security number, phone number, and email address. This part is relevant only for first-time applicants; if you've provided your details previously, the system already has them, allowing you to continue with the online loan application. Kviku promises that after the application is complete, money instantly will be transferred to your bank account.

Kviku loan requirements

-

The loan is intended for Filipino citizens between the ages of 20 and 55.

-

A single valid government ID is mandatory for Kviku, but supplementary documents like a payslip, COE, ITR, company ID, and DTI can be advantageous, especially if you are self-employed or own a business. The approval for repeat borrowers could be automated.

-

An active, unblocked mobile number is necessary.

-

Registration on the website is required.

Details about the Application

Upon contract signature, the requested amount is transferred within a 24-hour window. The transaction duration is decided by your bank, generally taking 1 to 2 days. Cebuana Cash Pick-up and G-cash transfers are completed within 24 hours on business days.

Kviku Loan Application Process

Application for an online loan via the Kviku website involves three simple steps:

-

Apply for a loan. Complete the online application form on their official website's landing page. Details required include your name, date of birth, SSS number, email address, and cell phone number, along with your photograph.

-

Await confirmation. After providing the necessary information, you will be notified via SMS whether your application is approved or rejected.

-

Once loan approved, your loan amount is transferred to your registered bank account within an hour.

Loan Repayment

Paying Kviku Loans in the Philippines:

Repaying a Kviku loan using a bank card:

-

Visit the official Kviku website and select "Repay".

-

Provide card information (card number, expiry date, cardholder name, and the three-digit code at the card's rear).

-

Input the SMS confirmation code sent to the registered mobile phone number.

Repaying a Kviku loan Philippines in cash:

-

In the user profile, select "Repay", followed by "Bank transfer". To make the payment form your bank account.

-

A new window will display the required bank details. Payments can be made at any accessible bank branch.

-

Be aware that bank transfers can take up to 5 days. To ensure smooth processing, email a dated payment confirmation to [email protected] to preempt any payment delays.

-

Upon loan repayment, a proof of payment is automatically generated, clearing the outstanding record. Successful repayment makes one eligible for subsequent loan applications.

For unresolved loan payments or repayment issues, reach out promptly to [email protected].

Kviku Loan App

Curious about a Kviku Loan App? Here's the update: Kviku is in the process of developing its app. The company assures that it will be accessible to users in the Philippines in the near future. It's anticipated that the app will be available for free download to all individuals residing in the Philippines.

Using the Kviku Loan Calculator

Determining the cost of a Kviku loan is straightforward.

-

Adjust the slider to your desired loan amount.

-

Using the next scale, select your preferred loan term.

-

Review the loan's total cost displayed under "Total repayment".

Support Details

The company proactively emphasizes its commitment to delivering superior credit services to Filipinos. This commitment is also evident in their customer service approach. While Kviku Philippines does not list a contact number, they can be reached via email at [email protected]. Upon reaching out, customers can expect a response within 20 to 30 minutes. Kviku's customer support operates between 9:00 and 18:00.

For those seeking the Kviku Philippines office address, it's situated at 18A Trafalgar Plaza, 105 H.V. Dela Costa Street, Salcedo Village, Makati City, Philippines. This location serves as their main office. Note that Kviku operates entirely online, so there are no physical branch locations for loan disbursement.

Sample Calculation of Interest and Loan Repayments

| TERM | 60 days | 61 days | 62 days | 63 days | 180 days |

| LOAN AMOUNT | ₱12500 | ₱12500 | ₱12500 | ₱12500 | ₱12500 |

| FEE PER DAY | 0.16% | 0.16% | 0.16% | 0.16% | 0.16% |

| INTEREST AMOUNT | ₱1200 | ₱1220 | ₱1240 | ₱1260 | ₱3600 |

| TOTAL REPAYMENT | ₱13700 | ₱13720 | ₱13740 | ₱13760 | ₱16100 |

Sources

FAQs

Kviku is a widely recognized Fintech firm, active in regions including Russia, Kazakhstan, Spain, Poland, and the Philippines, specializing in immediate online lending services. It maintains an online loan application platform enabling Filipinos to submit loan applications around the clock.

For any lending company to operate in the Philippines, it must be duly authorized. The securities and exchange commission (SEC) oversees this authorization process. On the official SEC website, you can locate the:

Upon verification, we found Kviku Lending Co. INC in the list of lending companies. Here are its details:

Company Name: Kviku Lending Co. INC. Registration No.: CS201918702 Certificate of Authority: 3169

This data confirms that Kviku is a legitimate lending company, as per the securities and exchange commission listings. It signifies that Kviku operates within the boundaries of the Philippine law, has undergone the necessary scrutiny by the regulatory bodies, and is trustworthy.

If you're wondering about the kviku Philippines review or its authenticity, rest assured. Kviku Philippines is SEC registered and has the necessary certification. Embrace a new era of advanced financial needs met by trustworthy companies like Kviku.

Interest rate: 56% APR (4,6% per month; 0,16% per day)

The trust of 100 million users testifies to the efficiency and value of Juanhand loans. Besides JuanHand loans, Kviku's online credit also offers a daily interest rate of 0.16%. For a clearer understanding of repayments, Kviku's website features a loan calculator. Simply input the loan amount and repayment duration, and the tool provides a detailed loan breakdown, including repayment dates.

It's important to mention that the interest rate might differ depending on the approved amount (which might be lesser than the amount initially applied for) and the chosen repayment duration.

Loans from Kviku range between ₱500 to ₱25,000, with a repayment duration spanning 3 to 6 months. For newcomers, Kviku sets an initial credit boundary. With timely repayments, this limit gradually increases, allowing users to qualify for larger loans.